Sales Tax New Jersey 2025. Lowest sales tax (6.625%) highest sales tax (8.625%). 628 rows 2025 list of new jersey local sales tax rates.

Need help with sales tax in new jersey? Some cities in new jersey are in “urban enterprise zones,” where qualifying sellers may collect and remit at half the 6.625 percent statewide sales tax rate (3.3125.

New Jersey Sales Tax Tax Rate Guides Sales Tax USA, Lowest sales tax (6.625%) highest sales tax (8.625%). Average sales tax (including local taxes ):

Is Clothing Taxable in New Jersey? The Daily CPA, If the due date falls on a weekend or holiday, the due date is the next business. Chronological listing of filing deadlines.

Taxidermy Local rates stuffed with fewer increases, New jersey sales & use tax rates change all the time and they differ depending on location too. 628 rows 2025 list of new jersey local sales tax rates.

New Jersey Sales Tax Sales Tax New Jersey NJ Sales Tax Rate, This comprises a base rate of 6.625% with no mandatory local. New jersey sales & use tax rates change all the time and they differ depending on location too.

New Jersey Sales Tax Sales Tax New Jersey NJ Sales Tax Rate, Afterwards, hit calculate and projected results will then be shown. On this page we have compiled a calendar of all sales tax due dates for new jersey, broken down by filing frequency.

Nj Tax Abatement Letter, New jersey sales tax map legend: This is the total of state, county and city sales.

Tax rates for the 2025 year of assessment Just One Lap, Use our calculator to determine your exact sales tax rate. Payment dates for weekly payers.

NEW JERSEY CORPORATE TAX COMPLIANCE INITIATIVE ANNOUNCED BKC, Last sales taxes rates update. New jersey sales and use tax rate in 2025 is 6.625%.

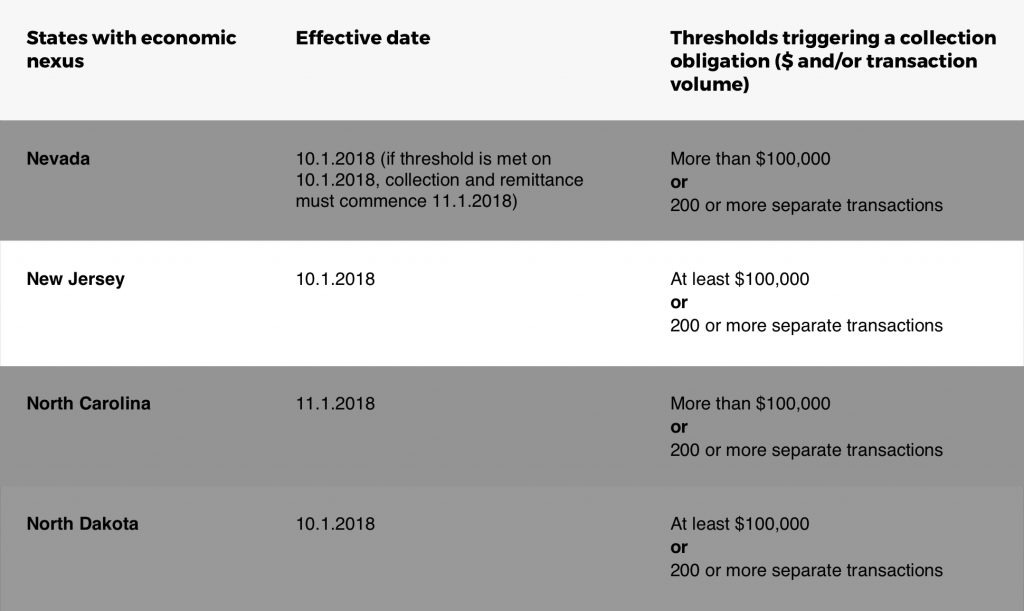

How to Interpret New Jersey Online Sales Tax Rules, Quarterly sales and use tax returns are due before 11:59 p.m. Some cities in new jersey are in “urban enterprise zones,” where qualifying sellers may collect and remit at half the 6.625 percent statewide sales tax rate (3.3125.

Form For New Jersey Sales Tax Exempt St 5 Tax Walls, New jersey sales and use tax energy return: Sales tax returns in new jersey are due on the 20th of the month following the reporting period.

The new jersey sales tax rate is 7% as of 2025, and no local sales tax is collected in addition to the nj state tax.